| ||||||

The Great

Retirement Ripoff!

You're Visitor #

Nothing in this site is copyrighted -- I'd be honored if you'd reuse anything you find here for your website

In the October 31, 2005 issue of Time, there were some articles describing "The Great Retirement Ripoff," one entitled "The Broken Promise" and the other "Where Pensions are Golden."

I've tried for a month to get permission to republish them, but numerous emails and phone calls have failed to get any reply, so I've decided to take a chance and just put them on this page. I figure since they're a month old, they're not selling that issue any more anyway.

Later, I found some related articles in USA Today. The latter are online on their site, so I'm putting the links below for your use. If any of the links don't work, email me and let me know. I've got the complete text saved, in case they take their articles off the internet. Below the links, you'll find a few tips on what you might do to possibly get around the problems discussed in the articles.

All pensions and health-care plans are not created equal. At the same time millions of workers in private industry have lost the benefits they once thought they had for life, another group is doing quite nicely, secure in the knowledge that their benefits are protected forever--not by some government agency, but directly by you, the taxpayer.

By DONALD L. BARLETT, JAMES B. STEELE

Same situation as for the first article.

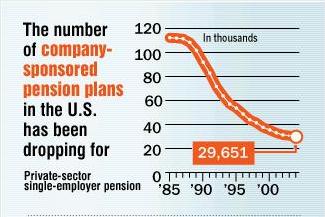

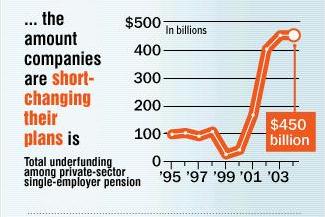

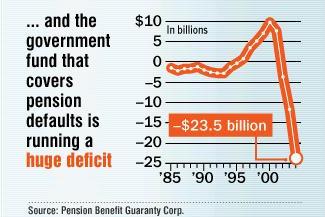

Pensions in Peril (graphs below)

I'm hoping Time won't care if I show these graphs, which were supplied by the PBGC.

David Walker, chief of Congress' non-partisan Government Accountability Office, describes the pension system as "fundamentally broken." He's frustrated that policymakers so far have been unable to solve a problem that's been documented over and over.

"There's a crying need," he says.

Business, Congress and the Bush administration agree that the U.S. system of private pensions is badly in need of fixing. What they haven't agreed on is how to fix it.

By Marilyn Adams, USA TODAY

Hoping to reverse the deterioration of pension plans covering 44 million Americans, the Senate voted Wednesday to force companies to make up underfunding estimated at $450 billion and live up to promises made to employees.

The action came a day after the federal agency that insures such plans reported massive liabilities and predicted a troubled future.

Associated Press

A Few Tips from the Oldguy

The articles cited above tell an extremely disturbing tale of broken promises, pensions in peril, and crying needs. The last one tells about action the Senate recently took to try to reverse the problem. What none of these articles tell you is what you, as an individual, can do to avoid some real problems in retirement. I suppose if I did a search on some related topics, I could find some suggestions from professionals, but I'll leave that as an exercise for the reader, if he/she wants to do it. What I intend to present below are some little things that I've noticed since retiring that might be of some help to you ... or you can ignore them, if you like. I certainly don't claim to have all the answers, just a few tips that might interest you.

1) If given a choice, I'd select taking my pension money as a lump sum instead of opting for long-term monthly installments. When I retired, I had the choice of taking the money in a lump sum or in monthly installments for as long as I lived. If I wanted to extend the payments to go to my surviving spouse after my death, I would get a slightly smaller amount. I decided to take the lump sum, since I obviously had no idea how long I'd live, how long my wife would live, or whether some unforeseen event (e.g., bankruptcy) might endanger the pension fund. One of the dangers of taking a lump sum is that while the monthly installments are more or less guaranteed, the investment of a lump sum might be lost due to stock market dips, etc. I chose to trust myself and relieve myself of the worry about future pension fund problems.

2) Company stock savings plans are great ways to increase your annual income, assuming you don't lose the money due to control restrictions. If you decide to join the stock plan, be sure to check the rules on who has control and when you actually own the stock. There have been several situations (e.g., Enron) where employees invested in company stock, but then weren't allowed to sell the stock when prices started to fall. In the case of Enron, I heard that while company officers were dumping their stock, employees were being told that things were solid and that they should continue to buy the stock. In another case, employees retired with large amounts, in the millions of dollars, in stock, but weren't allowed to sell it for some prescribed period of time. During the waiting period, the value dropped drastically, and they were left with virtually no retirement fund.

3) It seems 401(k) plans also may have some control questions. Before going too deeply into investing in them, check the rules. If there's a company matching amount, find out when it actually belongs to you.

4) Take advantage of the annual IRA contribution allowed by the IRS. This is a great way to put aside a little tax-free money while you're making the big bucks and paying the big taxes, then pull it back out after you retire when your tax rate is lower. The amount you're allowed to contribute seems to be changing every year, so keep your eye on the IRS rules to make sure you take full advantage of this option.

5) Keep current on legislation being considered regarding the Pension Benefit Guaranty Corporation and pensions, in general. Let your congressman know when there are changes being considered that affect you.

6) According to the "Crying Need" article in USA Today, "Every employer with a troubled plan is required to tell the PBGC each year how underfunded the plan would be if it had to be terminated. But the company is not required to tell the people directly affected: workers and pensioners. The PBGC is not allowed to tell." This would seem to be an area where the laws need changing. If the opportunity arises, bring this up to your congressman.

It was part of the American Dream, a pledge made by corporations to their workers: for your decades of toil, you will be assured of retirement benefits like a pension and health care. Now more and more companies are walking away from that promise, leaving millions of Americans at risk of an impoverished retirement. How can this be legal? A TIME investigation looks at how Congress let it happen and the widespread social insecurity it's causing.

By DONALD L. BARLETT, JAMES B. STEELE

WHOOPS! 11/30/2005: I just got a reply from Time Reprints department and it seems they charge $2000 to post one of their articles for a year. Sorry about that ... if you didn't get a chance to read it yet and are really interested, email me and I'll send you a summary of what was said. OR, if you're really interested, click the link on the article title and you'll see the start of the article and be offered the opportunity to pay Time to read the remainder.