How to Maximize Your Future: If you're still really young (under 45 or so), you can positively affect your Social Security by working someplace that deducts Social Security from your paycheck. Getting paid "under the table" in cash is great for the now, but really hurts you in the later. Same thing for those that work as an independent subcontractor, so your employer doesn't deduct SS and taxes. You're self-employed, so they assume you're handling that. If you don't, it will hurt you later. Your SS checks are based on your highest 40 quarters of employment. If you've been paying SS for less than 40 quarters (i.e., 10 years), they reduce your pay accordingly. It all boils down to whether you make it easy on yourself when you're younger or when you're older. Being old now, I'll tell you that you'll appreciate it much more when you're older!

How Couples Can Boost Their SS: Today I read a great article on Yahoo news, which is what prompted me to start this page. The article is a little complicated and takes time to read it all, but it has some great advice for those who haven't yet started drawing their SS. Basically, if you don't really need it until you're 70, it tells you how to collect money between 65 and 70 but still start getting the maximum amount at age 70. Husband starts at 65, then suspends. Then, wife draws 50% of husband's until age 70. At 70, they both start drawing full amount. Sounds like a great idea!

When to start drawing: I've seen a lot written on this and it seems that most financial advisors suggest that you wait as long as you can to make your check higher. I disagree! I sat down and figured it out when I was in my early 60s and calculated that if I started at 65, I would reach the break-even point at about age 85. That is, at 85, I'll have received the exact same amount, whether I started at 65 or waited until 70. Then, after age 85, I start seeing a higher amount if I waited until 70 to start. HOWEVER, what if you wait for age 70, but die at age 69 - OOPS! For me, it was also the case of needing the financial assistance between ages 65 and 70 ... if I'd waited to 70 to start drawing, my wife and I would have had a pretty meager existence during the last 5 years. As it turns out, we've had some unexpected sources of income besides the SS, but having that SS as a base pay has helped us feel more secure.

UPDATE : I just read an article on Yahoo News entitled "Wondering When to Take Social Security?" - it has sections labelled The longer you wait, the more you'll receive each year, one called I want it now, I could die tomorrow, and finally Let your income requirements lead the way.

To download the PDF article, CLICK HERE.

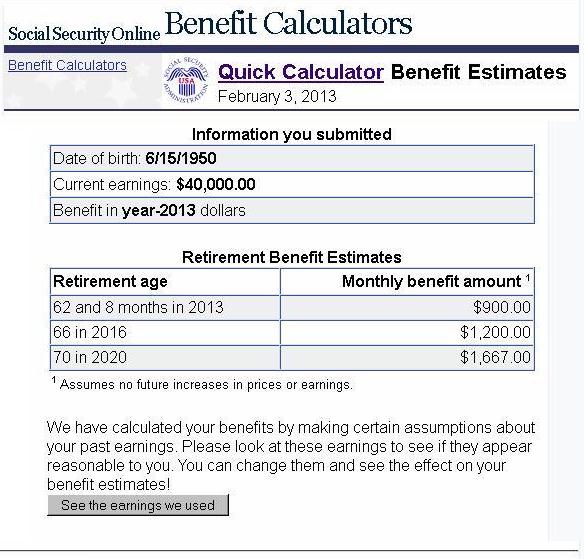

It also has a link to a benefits calculator, with results as shown below.

Social Security Tips

| ||||||

Retired? About to retire? If you're over 30, you'd better start planning! Here are a few ideas from an old retired guy.

Nothing in this site is copyrighted -- I'd be honored if you'd reuse anything you find here for your website

If each of you gave me a dollar, I'd have $

to spend in my retirement! hahahaha

Email the author of this website at rjhoffman@yahoo.com

*** Specific Topics of Interest ***

Retire!

RV Travel!

Invest!

Get Online!

Entertainment

Miscellaneous

The estimates shown on the left are the result of using the default values on the SSA Quick Calculator page.

But, here's what they don't tell you. Notice that if you start drawing at 62, you'll draw 4 years at $8400 per year by the time you make 66. That means it takes until age 78 for that the extra $300 to "catch up" to the earlier draw (i.e., by age 78, you will have drawn the same if you started at 62 or 66 - after that, the 66 has the advantage). Same sort of thing shows up by waiting to age 70 - see matrix below. By the time you get to 85 (if you do), waiting to 70 starts to pay off.

Lump-Sum Option

Little-known Social Security rules allow beneficiaries to receive lump-sum payments that can amount to thousands of dollars. Attractive as this may sound, such payments permanently reduce beneficiaries' monthly benefits and should generally be taken as a last resort.

Two of the ways to qualify for a lump sum are available only to those who start receiving benefits after reaching full retirement age. (That figure is gradually increasing to 67 years. You can find your full retirement age at ssa.gov/pubs/ageincrease.htm.) At full retirement age, an individual is entitled to 100% of his or her benefits. Those who claim earlier receive less, while those who delay get more—roughly 8% more for each year they delay claiming, until age 70.

Many people who claim benefits after full retirement age can elect a lump-sum payment of up to six months of benefits. (To get a full six months, someone with a full retirement age of 66 would have to delay claiming until at least age 66½.) The downside: Social Security permanently reduces your future monthly benefit.

To see how it works, consider a woman who would be entitled to a $2,784 monthly benefit at age 68. By taking a lump sum, she can pocket $16,008. But her monthly benefit will fall to $2,668—the amount she would have received had she started taking her benefits six months earlier, at 67½, says William Meyer, chief executive of SocialSecuritySolutions.com, a service that identifies Social Security claiming strategies likely to yield the highest amount over a beneficiary's life span. (The $16,008 comes from multiplying the monthly benefit at age 67½ by six months.)

Individuals who file for benefits on (or after) full retirement age and then suspend the payments can qualify for potentially larger lump sums—that cover every cent they suspended taking. A man entitled to claim $3,168 a month at age 70, for example, could opt instead for a lump sum of $115,200 and a monthly benefit thereafter of $2,400, the amount he would have received had he started his benefits at age 66, according to Mr. Meyer.

Those who take a lump sum may find that it pushes them into a higher tax bracket in the year they receive it and subjects more of their Social Security to income tax, says Russell Settle, partner in SocialSecurityChoices.com, which also evaluates claiming strategies. Moreover, he adds, while "there is no downside" for single individuals to file for and suspend their benefits to preserve the option of taking the largest possible lump sum in the future, for some couples "file and suspend isn't the optimal claiming strategy."

While it sounds morbid, the best candidates for a lump-sum approach are single people who know they don't have long to live. Indeed, if you have a strong reason to believe you won't make it to your 80th birthday, you—or your heirs—are likely to come out ahead with the lump sum, says Mr. Meyer.

For couples, it's important to consider the life expectancy of both spouses. To ensure the survivor has the highest possible income, it often pays for the higher wage earner to delay claiming Social Security benefits until age 70, says Mr. Settle. Even if that person dies before the benefits start, the survivor—who must live on one Social Security check rather than two—will inherit the higher amount.

If you need emergency cash, consider a partial lump sum, since it will reduce your benefit by less, says Mr. Meyer. First, though, calculate the cumulative benefits you would lose over your lifetime so you understand the trade-off, he adds.